The Price Dynamics of Gold Plus Float Glass An In-Depth Analysis

The intersection of gold prices and float glass production is a fascinating topic that deserves a closer look. In today's market, both commodities command significant attention due to their unique properties and the industries they serve. This article explores the relationship between the prices of gold and float glass, highlighting their market dynamics, influences, and implications for traders and consumers alike.

The Price Dynamics of Gold Plus Float Glass An In-Depth Analysis

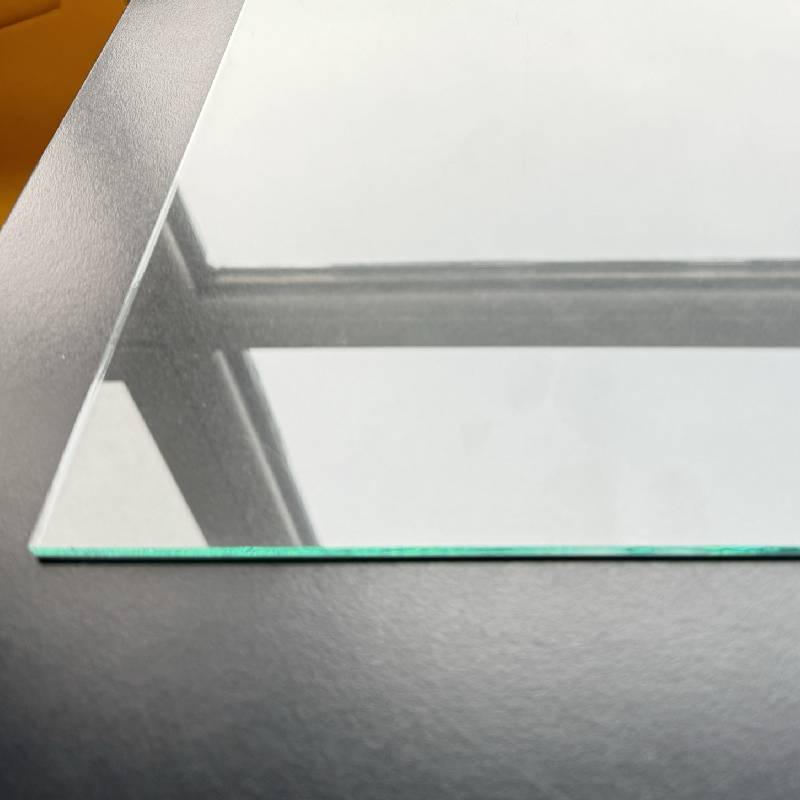

On the other hand, float glass, a key material in construction and automotive industries, is produced through a specialized process that grants it a flat and flawless surface. Its pricing is influenced by a different set of factors including raw material costs, energy prices, and technology advancements in manufacturing processes. The float glass market is also sensitive to shifts in demand from the construction sector, which is heavily influenced by economic growth and infrastructure projects.

The relationship between gold prices and float glass is not immediately obvious; however, both commodities are subject to the laws of supply and demand. For example, if gold prices rise substantially, the increased financial security that accompanies this can lead to heightened construction activity and, consequently, a rise in demand for float glass. Builders and manufacturers may feel confident investing in new projects, knowing that the economy is stable or improving, which in turn can drive up the price of float glass.

Conversely, fluctuations in float glass prices can indirectly affect gold prices. The materials used in float glass production, such as silica sand and soda ash, can experience price changes based on global supply chain issues or production disruptions. If the cost of these materials rises significantly, float glass producers may pass on the costs to consumers, potentially leading to decreased construction activity. A slowdown in construction impacts overall economic growth, which can cause investors to shift their focus back to gold as a safer investment.

As both industries adapt to changing market conditions, staying informed on global events and economic indicators can provide valuable insights. For investors in either commodity, understanding these intricate relationships is essential for making well-informed decisions. For example, analysts may look at construction permits, housing starts, and retail sales alongside gold price trends to predict movements in both markets.

In conclusion, the relationship between gold prices and float glass is complex and influenced by a multitude of factors. While they may appear unrelated at first glance, the dynamics of supply and demand interconnect both markets. As global economic conditions continue to fluctuate, keeping an eye on these two commodities provides valuable insights for investors and stakeholders in related industries. Whether one is trading in gold or float glass, understanding the broader market context is crucial for successful investment strategies.